Everything You Need to Know about Cigna Health Life Insurance Company (CHLIC) Transitioning to Medco Containment Health Insurance Company (MCLIC)

Medco Containment Life Insurance Company is a Cigna affiliate that exclusively serves Medicare beneficiaries. They specialize in providing life and health insurance services to individuals and families in the event of death or critical illness. MCLIC will replace Cigna Health Life Insurance Company (CHLIC) as the main insurer of Cigna’s medicare supplement insurance policies.

Policyholders will be notified about the transition through formal notices starting March 15, 2024 in some states and will continue until next year.

This appointment is meant to alleviate any concerns and there is no-cost or obligation to make a change.

Consent Period Per State

State | Consent Periods |

CO, KS, ME, NE, NC, RI | Policyholders have 25 months to consent to or reject the transition. Cigna is required to send a final notice 24 months after the initial communication. No response after 25 months is considered deemed consent. |

AL, AR, AZ, CT, DE, FL, IA, ID, IL, IN, KY, LA, MD, MS, MT, ND, NH, NJ, NM, NV, OH, OK, PA, SC, SD, TN, TX, UT, WV, WY | Policyholders have 90 days to consent to or reject the transition. If no response is received after 60 days, Cigna will issue a second notice. No response at 90 days is considered deemed consent. |

GA | Policyholders have 90 days to consent or reject the transition. If no response is received after 60 days, Cigna must issue a second notice. No response at 90 days is considered deemed consent. |

MO | Policyholders have 30 months to consent to or reject. Cigna is required to send a second notice 12 months after the initial communication, and a final notice at the 24-month mark. No response after 30 months is considered deemed consent. |

OR | Policyholders have 13 months to consent to or reject the transition. Cigna is required to send a final notice 12 months after the initial communication. No response after 13 months (30 days after final notice) is considered deemed consent. |

VT | Policyholders have 14 months to consent to or reject the transition. Cigna is required to send a final notice 12 months after the initial communication. No response after 14 months (60 days after final notice) is considered deemed consent. |

CA, MI, MN, WA, WI | Policyholders must provide affirmative consent to move their policy from CHLIC to MCLIC. Cigna will send additional notices at reasonable intervals to remind policyholders who haven’t replied to do so. |

VA | Consent period TBD |

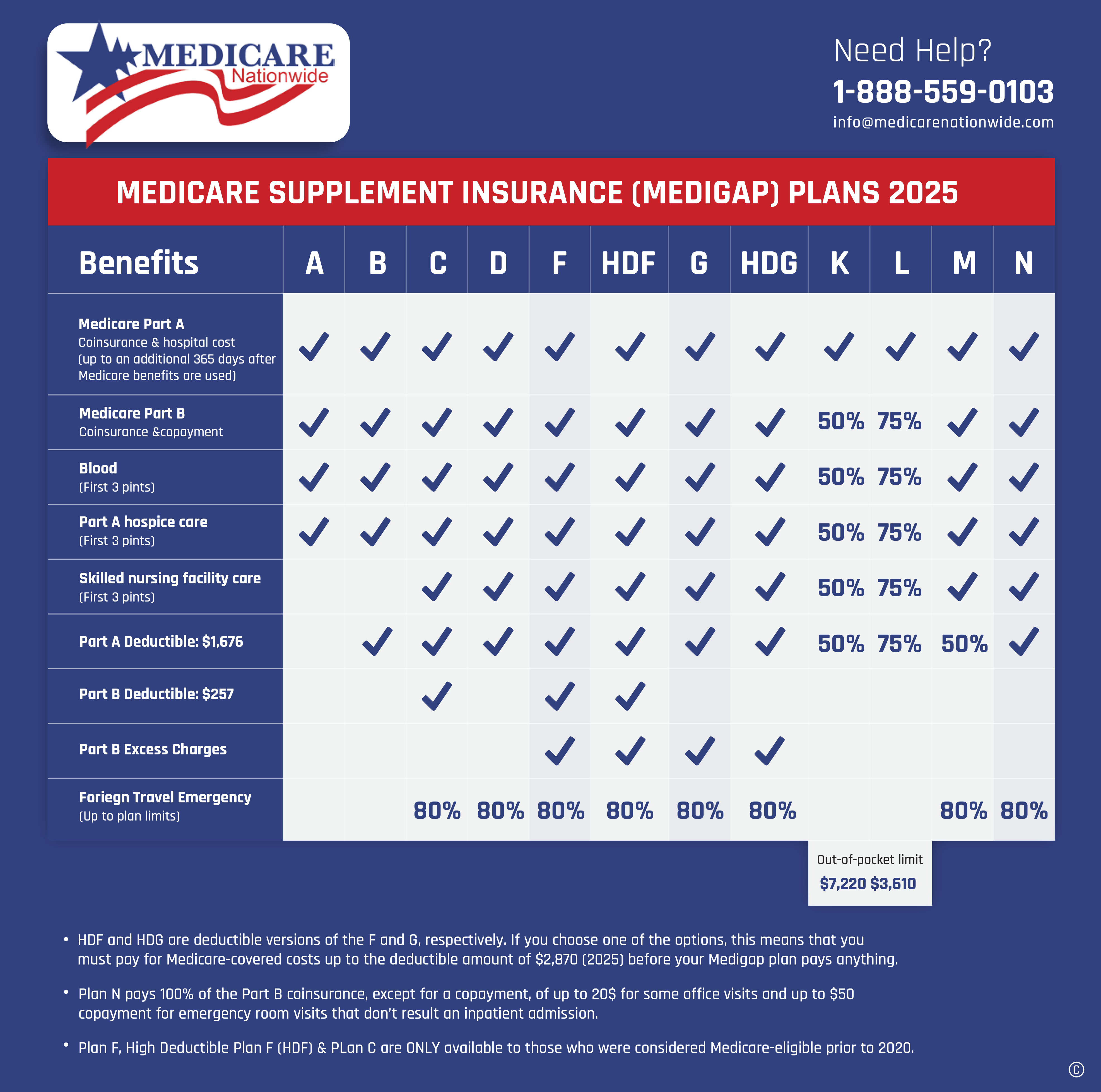

Medco Containment Life Insurance Company Medicare Supplement Plans

MCLIC Medicare Supplement offers standardized Medicare Supplement Plans in different states of the US. This chart is helpful to understand what coverage its plans have.

Medco Containment Life Insurance Company (MCLIC) also offers a Household Discount. When more than one person in your home enrolls in or is already enrolled in a Medicare Supplement coverage with Medco, you will receive a household discount.

Medco Containment Life Insurance Company offers Plans A, B, F, High Deductible F, G and N in most areas. Its costs are very competitive, and it offers many discounts to its enrollees. You are free to visit any doctor. Your coverage is portable and travels with you all across the country.

Brief Details of the Available Plans

Below are the plans offered by Medco Containment Life Insurance Company. Availability of these plans depends on the state you live in.

Medicare Supplemental Plan A

Medicare Supplement Plan A, a standardized Medigap plan, is meticulously crafted to complement Original Medicare (Part A and Part B). It serves as a safety net, covering a multitude of out-of-pocket expenses that may not be fully addressed by Original Medicare alone.

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care Coinsurance or Copayment

- Blood (first three pints)

- Medicare Part B Coinsurance or Copayment (after Part B deductible)

Medicare Supplemental Plan B

Medicare Supplement Plan B, one of the standardized Medigap plans available, is designed to complement Original Medicare (Part A and Part B) by providing additional coverage for various out-of-pocket expenses.

- Medicare Part A deductible

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care Coinsurance or Copayment

- Blood (first three pints)

- Medicare Part B Coinsurance or Copayment (after Part B deductible)

Medicare Supplemental Plan F

It is one of the most popular insurance plans in the Medicare Insurance market. Plan F covers almost all gaps that Original Medicare does not cover.

- Medicare Part A Deductible

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care Coinsurance or Copayment

- Skilled Nursing Facility Care Coinsurance

- Blood (first three pints)

- Medicare Part B Deductible

- Medicare Part B Coinsurance or Copayment (after Part B deductible)

- Medicare Part B Excess Charges

- Foreign Travel Emergency (Pays 80%)

Medicare Supplemental Plan HDF

Medicare Supplement High Deductible Plan F operates similarly to the traditional Plan F (HDF), providing extensive coverage for beneficiaries enrolled in Original Medicare (Part A and Part B).

- Medicare Part A deductible

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care or Copayment

- Skilled Nursing Facility Care Coinsurance

- Blood (first three pints)

- Medicare Part B deductible

- Medicare Part B Coinsurance or Copayment (after Part B deductible)

- Medicare Part B Excess Charges

- Foreign Travel Emergency (Pays 80%)

Medicare Supplemental Plan G

Plan G offers the same comprehensive coverage as Medicare Plan F except for the Medicare Part B deductible. This plan is a good fit for those people who want coverage for hospitalization but are willing to pay the Medicare Part B deductible on their own.

- Medicare Part A Deductible

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care or Copayment

- Skilled Nursing Facility Care Coinsurance

- Blood (first three pints)

- Medicare Part B Coinsurance or Copayment

- Medicare Part B Excess Charges

- Foreign Travel Emergency (Pays 80%)

Medicare Supplemental Plan N

One of the main features of Medicare Supplement Plan N is its extensive coverage. In addition, it is a more cost-effective and focused plan. It also pays for all costs associated with Medicare Part B coinsurance. The only out-of-pocket costs are that you have to pay $20 copays for doctor visits and $50 copays for emergency room visits.

Plan N coverage has:

- Medicare Part A deductible

- Medicare Part A Coinsurance and Hospital Costs (after Part A deductible)

- Part A Hospice Care or Copayment

- Skilled Nursing Facility Care Coinsurance

- Blood (first three pints)

- Medicare Part B Coinsurance or Copayment

- Foreign Travel Emergency (Pays 80%)

CHLIC Transition MCLIC – Commonly Asked Questions

Cigna Health and Life Insurance Company (CHLIC) will be replaced by Medco Containment Life Insurance Company (MCLIC) as the insurer of their Medicare Supplement insurance policies. Policyholders are being notified and will be transferred once they give their consent.

Who is MCLIC?

Just like Cigna Health and Life Insurance Company (CHLIC), MCLIC is also a Cigna Group subsidiary.

Will the transfer from CHLIC to MCLIC affect policyholders’ coverage or value-added services?

No, there will be no impact to coverage or value-added services for policyholders.

Will there be a rate increase after the transfer?

No, the transfer from CHLIC to MCLIC will not result in a rate increase. Policyholders will continue to receive normal annual premium rate change notices.

Will this change affect payments of recent claims under CHLIC?

No, claims will not be affected by the transfer and will continue to process as they do in the present.

Will this transfer affect the Household Discount policyholders currently receive?

No, this transition will not make any changes to Household Discounts.

What do policyholders need to do?

Policyholders must review notice packets and submit response cards to Cigna, who will send reminders if no response is received.

What can policyholders expect once they agree to the transfer?

As indicated in the policyholder notices, they can either accept or reject the transfer. If they agree to transfer, their policy will be transferred to MCLIC and will be maintained with no disruption. Policyholders will receive a new ID card for MCLIC and a MCLIC Certificate of Assumption which will serve as their new policy in the mail.

What happens if policyholders want to reject the transfer?

Policyholders have the right to reject the transfer. If they decide not to transfer, their policy will remain on CHLIC.

Will policy numbers change after the transfer?

There will be no changes and policy numbers will stay the same.

Are there any states or groups exempt from this transition?

Yes. Due to licensing rules in the state of New York, CHLIC policyholders who are New York residents are exempt from the transition at this time.

Medicare Supplement Plan Premium Average Cost Monthly

Rates can vary based on where you live. We have provided illustrative rates, and you might find your location cheaper or more expensive.

- The rates below were generated from ZIP code 97232 in Portland, OR, for females aged 65. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | FEMALE |

Plan F | $226.18 |

Plan G | $189.52 |

Plan N | $139.71 |

- The rates below were generated from ZIP code 80209 in Denver, CO, for females aged 65. Rates vary based on ZIP Code, Gender, Age, and, in some areas, Health.

PLAN | FEMALE |

Plan F | $198.71 |

Plan G | $168.21 |

Plan N | $130.35 |

What are the Next Steps?

If you have any questions or concerns about this transition and how it will affect your policy with CHLIC, please call us at 1-888-559-0103, and we will be happy to assist you!